2013 is undoubtedly a painful year for the domestic textile raw material market. In this year, cotton prices rose slightly, while polyester, nylon, acrylic, viscose and other chemical fiber varieties declined by 3% - 15%; domestic cotton production reduction has become a foregone conclusion, and the output is expected to decline by 12-13 percentage points compared with the same period of last year, while chemical fiber output continued to increase, but the growth rate slowed down by 4 percentage points compared with the same period of last year; cotton import volume decreased by 19.2% compared with the same period of last year However, the import and export of chemical fiber showed signs of differentiation, with an increase or decrease over the same period of last year. The overall yield of the industry continued to decline, and the yield of polyester and viscose industries reappeared negative values, which were - 1.10% and - 1.20% respectively. The operating rate of the industry generally fell below 80%, and the operating rate of polyester staple fiber was lower to 60%

From the deep texture of the annual market trend, many disadvantages caused by the imbalance between supply and demand are fermenting.

First of all, the imbalance of supply and demand leads to the fluctuation of low price and the compression of production profit space. Since last year, polyester, nylon, acrylic, viscose and other major textile raw materials market overall showed a downward trend, the average market price is generally lower than the same period last year. In addition, the rising cost of raw materials for upstream production and the continuous price reduction and promotion of chemical fiber factories have led to the deterioration of the overall profitability of the industry. During the year, most of the product processing profits remained at a low profit level, and some varieties lost money for a long time. In the first four quarters of last year, the average gross profit of polyester filament poy150d / 48F was 147 yuan / ton, 39.51% less than that of the first three quarters; the average gross profit of polyester staple fiber 1.4d * 38mm was - 163 yuan / ton, 4.49% less than that of the first three quarters.

Secondly, the imbalance of supply and demand leads to the continuous de stocking of production enterprises and the low operating rate. With the reduction of the scale of export orders and the blurring of the boundary between the weak and the peak seasons of domestic sales, the production enthusiasm of the downstream weaving enterprises has declined compared with the previous years, and the purchasing enthusiasm for textile raw materials is obviously lower than expected. In order to cope with the oversupply market, chemical fiber manufacturers began to take the initiative to reduce production, expecting to drive prices to stop falling and stabilize and rebound. During the Spring Festival, more than 20 polyester enterprises, such as Hengyi petrochemical, Xinmin technology and Baihong group, have maintenance plans. The total production capacity of production reduction and shutdown is over 7 million tons, which is the most shut-down year in the past 20 years.

Finally, due to the serious overstocking of the terminal textile and clothing inventory, the risk of capital recovery in the enterprises of texturing and weaving is increased. At present, the recovery rate of accounts receivable of water spraying enterprises in Shengze area is 50% - 70%, that of ammunition adding factories in Taicang area is only 50% - 60%, that of circular machine enterprises in Xiaoshao area is mostly 50% - 70%, that of warp knitting enterprises in Haining area is 60% - 70%, and that of ammunition adding and circular machine enterprises in Cixi area is even lower than 50%. In addition, the debt problem even extends to the spinning process. Some spinning factories have to accept the debt bill to ensure shipment.

The downstream demand for textile raw materials in 2014 is not necessarily better than in 2013. 2014 is the year of China's economic transformation. Economic transformation instead of digital growth has become a new focus of the market. It is expected that the new capacity of the domestic market is limited. At the same time, the global financial crisis is not over, and external demand is still relatively fragile. Therefore, the insufficient demand will continue to suppress the textile raw material market, coupled with the continued expansion of supply, the price index center of the main varieties is likely to further reduce. According to the forecast of the projects under construction and to be built, the domestic polyester filament production capacity is expected to increase by 3-3.5 million tons in 2014, the polyester staple production capacity is expected to increase by 800000 tons, the nylon production capacity is expected to increase by 400000-500000 tons, and the viscose production capacity is expected to increase by 350000 tons.

The overall price market is in recession, with a decline in most cases on a month-on-month basis and a year-on-year basis

According to the data of 10 main varieties monitored, in the domestic textile raw material market in the fourth quarter of 2013, compared with the price in the previous quarter, there were 3 products with price increase, accounting for 30%; 1 product with price unchanged, accounting for 10%; 6 products with price decrease, accounting for 60%. Compared with the same period of last year, the price center of most varieties of polyester filament, polyester staple fiber, nylon filament and so on showed a downward trend, while cotton and polypropylene staple fiber only slightly increased with a slight advantage.

[price increase champion] polyester filament rose 1.94% month on month

Reasons: in the fourth quarter of 2013, the market price of polyester filament stopped falling and rebounded, mainly because the demand for coarse denier yarn increased in autumn and winter, and the actual supply decreased. Since November, due to the large loss of polyester production, Shaoxing Yifeng, shuangtu new materials, Hengyi petrochemical and other mainstream production enterprises have successively reduced production, resulting in a tight supply of marketable specifications.

Aftermarket forecast: with the continuous shrinking of the orders of the terminal textile enterprises, the operating rate of downstream texturing and weaving enterprises is gradually lower, and the market rigid demand is facing serious downward pressure. However, it is worth noting that the maintenance plan of domestic polymerization spinning filament device is relatively centralized, which will play a certain role in restraining the decline of market in the later period.

[price drop champion] acrylic tow fell 7.76% month on month

Cause search: from November to December 2013, the upstream raw material acrylonitrile dropped by 800 yuan / ton, to 13300-13500 yuan / ton. While the acrylic fiber production platform moved down significantly, it also depressed the purchasing enthusiasm of the downstream yarn mills. In addition, the domestic textile sales gradually came to an end, the demand side was favorable and the support was reduced, and the inventory digestion of acrylic fiber manufacturers was slow. Under the influence of double negative factors, acrylic fiber producers were forced to reduce the price of products, and the focus of actual transaction price also fell.

Aftermarket forecast: on the one hand, after the sharp decline in the early stage, the price of raw material acrylonitrile rebounded, which has a supporting and promoting role on the acrylic fiber market. On the other hand, Qilu Petrochemical, Ningbo Zhongxin and other acrylic fiber production enterprises have certain maintenance plans, and the reduction of supply will also benefit the market. It is expected that the market price of acrylic fiber will gradually stabilize in the later period.

The yield of cotton decreased significantly year on year, and the yield of chemical fiber continued to increase slightly

Affected by the decrease of planting area and bad weather, China's cotton production will decrease compared with last year, and the number will decrease compared with the previous forecast. According to the statistical data of China Cotton Association in November 2013, it is estimated that the national cotton output in 2013 will be 6.77 million tons, 3.17% month on month decrease compared with the forecast value of last month, and 12.50% decrease compared with the same period of last year. At the same time, the domestic chemical fiber production figures continue to grow, but the growth rate has slowed down. According to the statistics of China Chemical Fiber Association, from January to November 2013, the total output of chemical fiber in China reached 37.641 million tons, an increase of 7.6% over the same period of last year, and the growth rate slowed down by 4.1 percentage points over the same period of last year. In the molecular industry, from January to November 2013, the output of man-made fiber was 3.9 million tons, an increase of 18.4% over the same period of last year; the output of synthetic fiber was 3.0019 million tons, an increase of 5.7% over the same period of last year.

[champion of output growth]

Reasons for the 26.80% year-on-year growth of spandex: according to statistics, from January to November 2013, the domestic spandex output was 354000 tons, a substantial increase of 26.80% over the same period last year. Since last year, affected by the recovery of terminal textile demand, coupled with the limited newly added domestic production capacity, the supply-demand relationship of spandex market has improved significantly, and the output and sales volume of relevant enterprises have increased significantly. At the same time, the price of spandex products continued to rise, and the price of 40d spandex rose from 44000-45000 yuan / ton at the beginning of the year to 50000-52000 yuan / ton, an increase of 14.61%.

[champion of production decline]

Reasons for the 1.50% year-on-year decline of polypropylene fiber: according to statistics, from January to November 2013, the domestic production of polypropylene fiber was 274000 tons, a slight decrease of 1.50% over the same period last year. This is mainly because the upstream raw material PP price rises, the cost side runs at a high level, but the price of polypropylene products can not go up synchronously, resulting in the decline of the profits of polypropylene production enterprises, the increase of industry production reduction and shutdown, resulting in the decline of the actual production of polypropylene fiber. Taking the PP granular drawing grade in East China market as an example, from 10900-11100 yuan / ton at the beginning of January 2013 to 11900-12100 yuan / ton at the end of December 2013, an increase of 9.09%. In the same period of time, the price of PP staple fiber is basically stable between 12400-12800 yuan / ton, not rising with the rising price of raw materials.

Import and export

Compared with the same period last year, the import volume of cotton decreased significantly, and the export volume of six chemical fiber varieties increased. According to the statistics of the General Administration of customs, China imported 4.148 million tons of cotton from January to December 2013, a year-on-year decrease of 985200 tons or 19.20%. From September to December 2013, China imported 1123900 tons of cotton, a year-on-year decrease of 246300 tons, or 17.98%. The export data of domestic chemical fiber varieties in 2013 showed different performance. According to the statistics of customs, from January to December 2013, the export volume of nylon 6 filament, nylon staple fiber, viscose filament and viscose staple fiber was 57300 tons, 4200 tons, 62300 tons and 188500 tons, respectively, which were lower than that of the same period of last year, ranging from 2.33% to 34.89%, while the export volume of polyester filament, polyester staple fiber and spandex was higher than that of the same period of last year.

[largest increase in export] acrylic tow increased by 176.92% year on year

Reasons: from January to December 2013, China exported 3600 tons of acrylic tow, an increase of 176.92% over the same period of last year. On the one hand, the export volume of countries such as Bangladesh and Pakistan, the traditional major export destinations, has grown steadily; on the other hand, non major export markets have also ushered in development opportunities, especially the export volume to Turkey has increased significantly. From January to December 2013, China exported 1440.95 tons of acrylic tow to Turkey, an increase of 1440.55 tons year on year.

[the biggest reduction in export] nylon 6 filament decreased by 34.89% year on year

Reason exploration: compared with 2012, the main export destinations of nylon 6 filament in China have not changed, and are still South Korea, Vietnam, Hong Kong, China and other regions. However, due to the poor global economic environment and the adverse impact of RMB appreciation, the number of exports decreased significantly compared with the same period of last year, by 34.89%.

[the biggest reduction in import] the year-on-year decrease of viscose filament is 86.67%

Comprehensive performance: in terms of import, from January to December 2013, the import volume of five varieties of polyester staple fiber, nylon 6 filament, spandex, acrylic staple fiber and viscose staple fiber increased from the same period of last year, with a range of 0.51% - 35.10%. At the same time, the import volume of polyester filament, nylon staple, acrylic wool, acrylic tow and viscose filament decreased compared with the same period of last year, among which viscose filament decreased by 86.67% year on year, becoming the champion of the drop list.

Profit polyester and viscose hovering low nylon and spandex continue to improve

From the perspective of gross profit, in the fourth quarter of 2013, the processing profit of polyester, viscose and other major chemical fiber varieties remained at a low level, and even some products lost money for a long time, but the profit of nylon and spandex continued to improve.

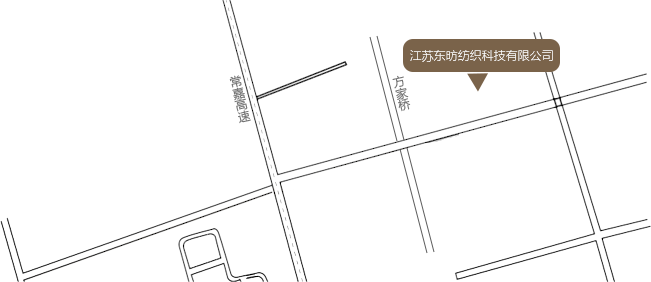

Address: Rooms 1-5, No. 130, Qingsong Road, Yushan Town, Kunshan City, Jiangsu Province

Address: Rooms 1-5, No. 130, Qingsong Road, Yushan Town, Kunshan City, Jiangsu Province

![]() Company telephone:0512-50333268

Company telephone:0512-50333268

![]() Company mailbox:dongfang@dongfang-tex.com

Company mailbox:dongfang@dongfang-tex.com

![]() Company fax:0512-57733709

Company fax:0512-57733709